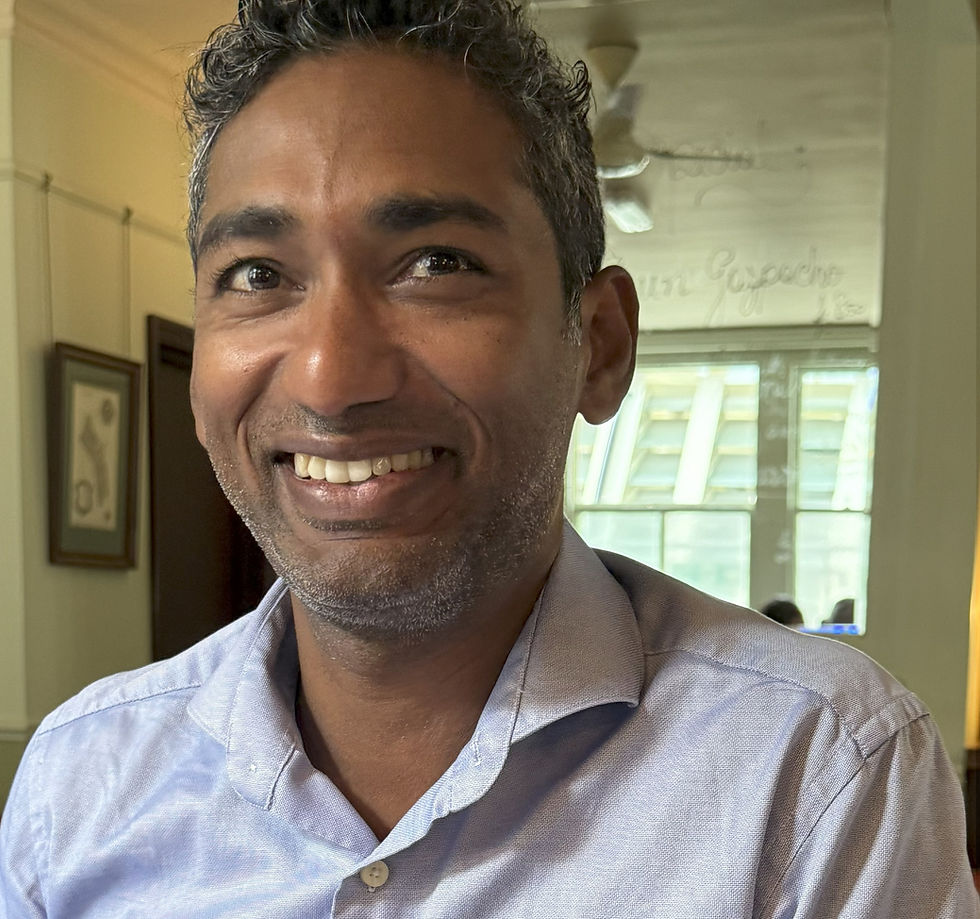

Meet The Team: Richard Woodhull

- Apr 24, 2025

- 5 min read

Updated: 6 days ago

Thursday, 24th April 2025

By Paula Perrelli dos Anjos

After a long and busy Monday, I had the pleasure of connecting online with Richard Woodhull, an enthusiastic Amazonia Impact Ventures (AIV) Investment Committee member and an experienced Impact Investing leader. Despite the late hour, his passion for driving impact through innovative financing was evident. In our conversation, we delved into how his expertise aligns with AIV’s work and how working with emerging markets often requires creativity, resilience, and a genuine commitment to change. In this exclusive interview, he offers not only sharp insights into the realities of working in volatile markets but also practical wisdom on fostering sustainable livelihoods.

By Paula Perrelli dos Anjos

How did you first meet the people at AIV?

I first met Pajani (Singah) and Aldo (Soto) at a Social Impact course we took at Oxford University back in 2019. Although we had initially connected there, they went on to co-found the company with other people, and I was not involved then. I was living and working in the US at the time and had heard about how AIV was progressing. Then, in March of 2022, I accepted a new job here in London and relocated with my family to the UK.

It was at that point that I reconnected with Pajani and learnt in more detail about the work they were doing, and I started to think about how I could support them informally through my network in the impact investing space. At a certain point, they thought my experience on the investment side, having worked at development finance institutions, would add a useful perspective to their Investment Committee. When they asked me to join, there was no question about taking on the additional role to support the great work AIV was already doing.

What drew you to collaborate with Amazonia Impact Ventures and share your expertise with us?

I like that AIV is an impact-first investor, and they genuinely strive to support the livelihoods of the farmers they work with. I thought one of the most unique things they're doing is the impact-linked incentives, which offer better pricing to the borrowers based on achieving specific, measurable environmental targets. There are very few impact funds that are doing that successfully. I think what is particularly compelling is that AIV is taking action on this front rather than just talking about it and finding ways to improve the incomes of the downstream farmers that they support.

The focus on South America and the Amazon region also attracted me, as it complements my day job, where I am more focused on the African and Asian regions. These days, I am more involved in working with intermediaries and building financial structures focused on mobilising commercial capital to developing markets at scale.

Being able to develop a more tangible connection to the environmental impact AIV creates - supporting smallholder farmers while preserving nature - has been the most meaningful part of this role for me. In the future, I hope to join the team for site visits to the region.

What do you love most about your day job, and how is this associated with your collaboration with AIV?

My day job is focused on supporting low-income people in several emerging markets, finding unique and innovative ways to expand access to financial services and supporting job creation. I love meeting with entrepreneurs in these markets to see the interesting ways in which they are building businesses in the local context. There are a lot that can be transferable from one market to the next, and there are a lot of similarities with AIV’s focus on livelihoods and improving the incomes of rural farmers.

Can we explore the trends that you see happening in the industry for the next few years?

I think one that is both an immediate-term challenge and an opportunity is that governments are withdrawing money from traditional development aid that might have benefited the types of farmers that AIV tries to reach or others in their supply chains. I think the decline in traditional aid money leaves a short-term void that will likely negatively impact low-income communities in these regions.

I believe this pullback emphasises the need to have more sustainable sources of capital or lenders like AIV, that can play a similar role in supporting these farmers with both finance and technical assistance in a way that can be more financially sustainable. And I think that's a trend that's been happening for a while, as governments increasingly look to replace traditional aid with private sector-led programs, but it’s certainly become more pronounced in the current environment.

There's also a lot more appetite from investors now for these types of impact-first strategies that aren’t solely profit-maximising. The emphasis is shifting towards making a financial return alongside delivering benefits for others, and this creates an opportunity for AIV to step in and provide support to farmers in a way that’s both innovative and impactful.

We often have to discuss the importance of having patient investors who focus on natural capital. What are your views on this?

I think it's been quite challenging in recent years when the interest rate environment has been high, and people can get a decent return on their money from a pretty low-risk investment in government bonds.

One of the selling points, however, is that people realise certain emerging market risks can be fairly uncorrelated with those in the US market. So, if investors are looking to diversify risk with funds that are less correlated with traditional assets, AIV might be able to provide that. It’s a compelling approach to balance both financial returns and meaningful impact.

I think many people are also beginning to realise the benefits of private credit strategies and both the return and liquidity that can be more predictable, which is especially valuable in more volatile times.

What have been some of the most valuable lessons throughout your career?

The main things I've learned have been both patience and flexibility, particularly when working in emerging markets. There are always unanticipated challenges that come up. One moment you’re working on a transaction, and suddenly a war starts in the country, laws change, or politics shift. It can happen anywhere, but emerging markets are often more volatile, and things are often less stable.

To successfully close the transactions I’ve worked on, I’ve had to be both creative and adaptive in solving problems as they arise. Not letting something that doesn't go to plan derail a transaction completely. Always working to find solutions, creating ways to mitigate these risks to ultimately close the deals and achieve the end impact.

I guess, at the end of the day, I would say it's about putting yourself in the shoes of the end borrower and understanding all of the risks and challenges that they face in their day-to-day. Small enterprises often struggle with basics like communications, transportation, or navigating bureaucracy. We have to be flexible and adaptable to help them overcome these challenges.

#MeetTheTeam #SustainableLeadership #ImpactJourney #LatinAmericaFocus #ClimateInvestments #AmazingAdvisors #BestTeam

Comments